Earthbanc 2022 Highlights: Media, News, Podcasts, and More!

Earthbanc achieved significant milestones in 2022 that we are proud of. Here are some of the highlights!

- 🚀 Our joint effort with the UNCCD and NGO partners now covers a pipeline of up to 100 million hectares of land for carbon removal projects.

We launched the world’s first climate fintech partnership with the United Nations Convention to Combat Desertification on land restoration and carbon finance that integrates innovative forward contracts and digital MRV for the Great Green Wall of Africa and large scale land restoration in India. The Earthbanc MRV App now has more than 4,000 users from NGOs, farmers, land stewards and businesses covering over 90,000 Hectares of land where we are financing and coordinating reforestation and agroforestry.

We are excited to share Earthbanc growth metrics for 2022:

– increased our carbon projects under development 7-fold

– increased our user base by 10-fold

– user growth was about 100% month on month.

- 🌱 Earthbanc scaling up carbon markets in the world’s single largest carbon removal project:

Earthbanc’s carbon portfolio has increased by 7-fold and we won the Trillion Trees Sahel and Great Green Wall Challenge, to scale up carbon markets in the world’s single largest carbon removal project, which will draw down 250 million tonnes of carbon. The carbon revenue generated for farmers could be valued at or above $10 billion over the life of the project.

- 📝 Earthbanc CEO and founder, Tom Duncan interviewed by Forbes and TIME:

Our team presented at COP27 events and about 30 other conferences, webinars and events throughout 2022, and were honoured to be featured in Forbes and TIME magazines.

👇🏾Want to know where to look for them? We’ve saved you some time by pinning these resources:

📌Forbes Article Link:

📌TIME Magazine Link:

📌COP27 Climate Hub Video Link:

📌To watch the whole stream please click here.

Video points- 5:36:09 Susan Gardner and Tom Duncan on ‘We Can Do It! Financing The Net Zero Transition.

⚡️What’s Next for Earthbanc in 2023?

“We are excited to deliver carbon projects and finance across the world, with significant projects being developed across many African nations, many states in India, and some exciting project announcements are coming soon. Here’s wishing everyone a regenerative 2023.

Our vision in 2023 is to scale up land and water restoration massively together with our partners, and help farmers achieve their vision of healthy ecosystems, abundant water and food, and biodiversity restoration and conservation. If you are a business committed to net zero and seeking to secure that outcome – please talk with our VP of Sales – Ben. If you are a land steward, farmer, or NGO please reach out to us via this contact form and let’s talk about your reforestation or agroforestry project!”

Contact: VP of Sales – Ben

🆕 Redesigned website for the better

Exciting News!

We’ve just launched our newly redesigned website. Our new site is easy to navigate, filled with engaging content, and optimized for mobile and application viewing. Visit us today to stay up-to-date on the latest news, tips, and resources in our industry. Don’t forget to subscribe to our newsletter to receive exclusive content straight to your inbox. Thank you for your support!

💡 Many thanks to our Investors, Partners and Supporters!

Katalista Ventures, Regen Network Development, Inc, Cerulean Ventures, CM-Equity AG, ImpactAssets, Rampersand, Sting,1t.org, United Nations Convention to Combat Desertification (UNCCD), Regen Network Development, Inc, Smarthead, UpLink – World Economic Forum, ROCKIT Vilnius, European Space Agency (ESA) Incubator, Swedbank, Mastercard

November, 2022

🎤 Earthbanc is a winner of the 2022 Trillion Trees: Sahel and Great Green Wall Challenge, in partnership with the United Nations Convention to Combat Desertification (UNCCD)

Earthbanc will bring its MRV, finance and forward contract technology to the Great Green Wall, that is restoring 156 million hectares of land, and is expected to generate 250 million tonnes of carbon.

Source: Watch video here.

This is the world’s single largest land restoration and carbon removal project that will ensure food, water and financial security for millions of farmers across the Sahel and Great Green Wall countries.

Africa’s Great Green Wall for the Sahara and the Sahel Initiative, led by the African Union Commission, is a bold vision to restore 100 million hectares of degraded land across the continent by 2030. In a region highly vulnerable to climate change, grappling with drought, resource scarcity, conflict and migration, at-scale landscape restoration is urgent to counter desertification and ensure livelihoods for a population largely dependent on agriculture. -1t.org

Earthbanc’s MRV app is featured in the winning ecopreneur video of the 1t.org.

Watch the full video here.

We are looking forward to creating valuable impact alongside the other incredible winners – Noël OBOGNON, Green energy Mali, Herou Alliance Mamadou, DIAKITE, Women’s Action for Integrated Development, Adewumi Owolabi, Pierre-Gilles COMMEAT, Abdoulaye Souare

🎤 Katalista Ventures offsetting with Earthbanc

🌏 Earthbanc x Katalista Ventures: In support of Sundarban ecosystem restoration and soil erosion management. Offsetting 50.8 tonnes of emissions boosts local economies and wildlife.

“True to our Triple Top Line value of bringing a positive impact on people, the planet, and profit, we wanted to make sure we first measure and manage our organisation’s carbon footprint over the past five years.

We had our portfolio startups Planet Positive and Earthbanc come in to help us with this task. The team at Planet Positive supported us in collecting all the necessary data to calculate our carbon footprint, while Earthbanc helped us find a trustworthy and impactful offset project to compensate for 200% of our emissions and become climate positive.

By offsetting 200% of our emissions with Earthbanc, we support critical ecosystem restoration and soil erosion control in the Sundarban region of India. Offsetting 50.8 tonnes of emissions creates many valuable benefits for people and the planet, by providing additional economic opportunities to local communities and supporting local biodiversity.”

Are you looking for a trusted partner to offset your emissions?

Or are you interested to learn more about our carbon removal projects?

Get in touch! VP of Sales, Benoit Marmillod would love to discuss how we can help you reach your sustainability goals while maximizing your social and environmental impact.

Read the full article here.

Soure: Katalista Ventures

December 2022

🎤 Earthbanc planted 10,000 trees in Germany in partnership with walk15 app, which currently has over 420,000 users

As part of its efforts to protect the environment, restore biodiversity, and support local ecosystems, Earthbanc planted 10,000 trees at a selected location in western Germany. The plantation was conducted in partnership with the walk15 app which has a user base of over 420,000 and growing. A tree planting program has a multi-fold impact on the environment, which reduces the effects of climate change, sequesters carbon dioxide, provides bios benefits, reduces soil erosion and water quality impacts, and mitigates the harmful impacts of climate change.

The trees were selected to suit the local ecosystem to be resilient against insect and beetle attack that has decimated European forests. The saplings planted were carefully stored and transported before they were planted. We are looking to expand to further countries including the Baltics and Western Europe – look out for more tree planting and forward contracts on carbon!

“We are planting saplings to ensure that the trees are healthy and they get a good start in their life. A good start means a successful forest and a successful forest means a greater impact to the environment and to climate mitigation. Planting saplings and digitally recording the information, also ensures that we are able to monitor the trees with satellites and train our machine learning models. We know exactly where they are, how old they are there, how healthy they are and the amount of carbon they are sequestering.” – Bo Kofod, the Director of Carbon Engineering and MRV at Earthbanc

October 2022

🎤 Earthbanc’s CEO, Tom duncan interviewed by TIME | Why It’s So Hard to Put a Price on Carbon

TIME interviewed Earthbanc’s CEO, Tom Duncan to explore the challenges and opportunities with regards to the accuracy of claims in carbon markets, pricing and finance.

TIME interviewed Earthbanc’s CEO, Tom Duncan to explore the challenges and opportunities with regards to the accuracy of claims in carbon markets, pricing and finance.

“Integrity matters because registry documents from project developers can be five years old, in which time forests can burn or be cut down. Also, most carbon registries currently rely on manual measurements locally, which can lead to errors, so carbon buyers may not know the most accurate and up-to-date status of a project”, says Tom Duncan, CEO of Earthbanc. – TIME

In 2022, Earthbanc partnered with the United Nations Convention to Combat Desertification (UNCCD) to launch carbon pre-purchase agreements to finance carbon credits.

Earthbanc works with carbon project developers, NGOs, and farmers to pre-sell a portion of their projects to help finance them in advance. We can wrap this purchase up in a digital Sustainable Land Bond developed in partnership with the UNCCD.

“This would not only pay farmers to plant and protect trees, but also support impacted communities through future carbon revenue streams. This is part of climate justice,” Duncan says. “As carbon prices increase, people most vulnerable to climate change deserve that compensation to enable them to adapt to a changing climate and ensure they have food and water security.”

During COP27, as we look to accelerate climate action and finance net zero it is important that we include climate justice at the core of carbon markets, serving the most climate vulnerable farmers in the world with new financing mechanisms.

Check out the TIME’s full article to find out how Earthbanc, in partnership with the United Nations Convention to Combat Desertification (UNCCD), backed by the European Space Agency (ESA) Incubator, is working to address climate justice and finance land restoration

Read TIME’s full article interviewing Earthbanc’s CEO, Tom Duncan here.

November, 2022

🎤 Presenting ‘Carbon – the exponential growth asset class’, Earthbanc’s CEO, Tom Duncan and CFO / COO, Chau Tang-Duncan joined the CM-Equity AG Investment Summit

Earthbanc’s CEO, Tom Duncan and CFO / COO, Chau Tang-Duncan, recently joined the CM-Equity AG Investment Summit. Hosted by the talented- Michael Kott, Jørgen Leschly Thorsted and the entire CM Equity team.

Tom presented ‘Carbon – the exponential growth asset class’, highlighting the underlying ESG and regulatory drivers that resulted in voluntary carbon market prices growing 400% in 2021, for some carbon assets, with nature-based solutions carbon growing nearly 300%.

Earthbanc enables corporations and asset managers to lock-in low long-term carbon prices through forward contracts. The future carbon credits that will be issued can be used to offset unavoidable emissions at a fixed price for 20 years. Asset managers with over $20 trillion AUM have committed to net zero – and Earthbanc enables offsetting of their portfolios, and the ability to sell the remainder of carbon credits, upon request, which enables asset managers to access the price growth of the underlying asset.

Are you interested to learn more about our carbon removal projects? Get in touch, we would love to discuss how we can help you reach your sustainability goals, while maximising your social and environmental impact.

November, 2022

🎤 Alex Gibb with Triple Top Line Podcast interviews Tom Duncan CEO of Earthbanc | Can startups accelerate carbon removal?

Alex and Tom discuss Tom’s journey from measuring trees with a tape measure to developing cutting edge MRV technology using satellite imagery and AI to provide the most accurate carbon removal projects. Tom also shared how the carbon market can fund climate justice and his advice for starting an impactful ClimateTech start-up.

In this episode, they covered many topics, such as voluntary and regulated carbon markets, carbon offsetting, fundraising tips for climate tech startups, and more.

“With satellite imagery, projects can be monitored continuously. This can ensure that climate claims are backed by real data, and are verifiable and credible, especially in the light of the anti-greenwashing clause in the European Sustainable Finance Disclosure Regulation. We need a lot more climate tech companies out there solving real problems” – Tom Duncan, CEO of Earthbanc

Listen to the podcast now on Spotify, click here.

November, 2022

🎤 Earthbanc’s CEO, Tom Duncan speaks at Cop27 ClimateHub with We Don’t Have Time and UNDP

here: https://www.youtube.com/watch?v=06fapRvkkoI

Video points- 5:36:09 Susan Gardner and Tom Duncan on ‘We Can Do It! Financing The Net Zero Transition.’

October, 2022

🎤 In depth discussion regarding ‘Why Don’t We Act Although We Know Everything About the Climate Crisis’

Benoit Marmillod did a fantastic job in his first public event for Earthbanc! Special thanks to ROCKIT Vilnius, Jovita Tamosaityte, Greta Monstavice and Eglė Žeimė.

In case you missed it, you can view the recording here, the action kicks off from 15:00 in this link here.

And let’s all take that critical step from intention to action

October, 2022

🎤 Earthbanc featured in Springwise Intelligence, our Carbon Investments backed by AI and Satellite Data

“Earthbanc uses remote sensing technology to audit the carbon stocks of forests”

Earthbanc is featured in Springwise Intelligence regarding our use of AI to increase the accuracy of carbon credit claims, and also better finance carbon removal projects.

Read article here.

October, 2022

🎤 Earthbanc is growing!

We are pleased to welcome Benoit Marmillod to the Earthbanc Team!

Ben joins as VP of Sales, he brings valuable experience having worked for over 10 years developing business strategy and scaling some of Europe’s fastest growing tech companies.

He is also an active part of his local start-up community, mentoring entrepreneurs to set-up robust business development strategies. Ben is looking forward to working closely with companies to help them achieve their emission reduction or net zero goals.

We hope you will join us in welcoming Ben to the team. If you have any ideas or suggestions they would love to hear from you, please add them in the comments below

View our full Earthbanc Team here.

🎤 We are proud to support Telia to offset their carbon emissions.

“Telia Company chose Earthbanc to supply carbon offsets due to their Satellite and Remote Sensing AI data driven approach to auditing carbon offset projects. They ensure the carbon being claimed is accurate and precise when reported”.

Telia is one of the largest telecommunications, mobile and internet-backbone companies in the Nordics and Baltics, with annual revenue of $10 billion. They are committed to reaching net zero by 2030.

Are you looking for a trusted partner to offset your emissions? Or are you interested to learn more about our carbon removal projects?

Get in touch! Benoit Marmillod would love to discuss how we can help you reach your sustainability goals, while maximising your social and environmental impact.

Earthbanc offers highly accurate carbon removal and offset projects. Our auditing approach is venture backed by the European Space Agency (ESA) Incubator. We use satellite imagery and AI remote sensing to accurately measure the carbon in trees, vegetation and soil, so you can be confident in your claims.

October, 2022

🎤 We Don’t Have Time Webinar – Inaccurate carbon offsets are a threat to solving the climate crisis.

Visit here to learn more: https://app.wedonthavetime.org/profile/earthbanc

Tom Duncan, Earthbanc’s CEO, was delighted to join We Don’t Have Time’s partner webinar to discuss how we can address the issue of inaccurate carbon offsets to realise the important potential of nature based carbon removal. Tom shared Earthbanc’s commitment to preventing greenwashing with our pioneering MRV technology to provide accurate and effective carbon removal projects.

September, 2022

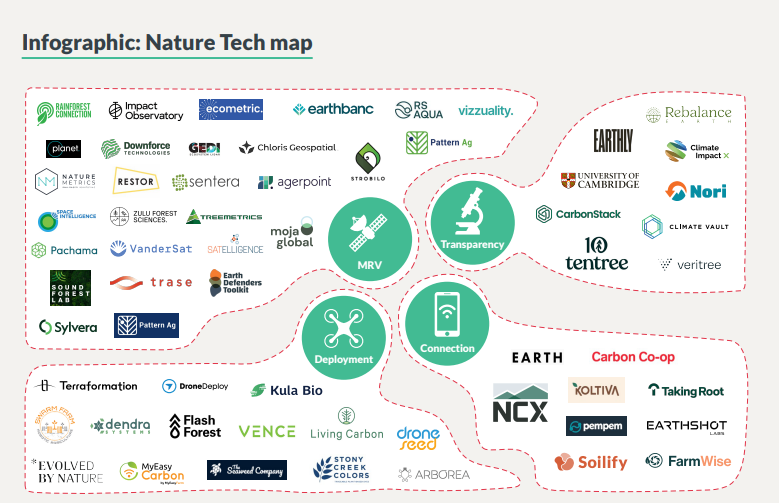

🎤 Earthbanc named as a key MRV tech provider in Nature4Climate white paper on NatureTech to solve the climate and nature finance gap

“When it comes to sophisticated operating systems, nature trumps all. But a wave of technologies is lending Mother Earth a helping hand when it comes to meeting the climate crisis with Nature Based Solutions.” – Nature4Climate

We are proud that Earthbanc is featured in Nature4Climate’s ‘NatureTech Whitepaper’ due to our patented MRV and AI technology, which is a venture backed by the European Space Agency (ESA) Incubator. Earthbanc’s pioneering technology is improving the accuracy and transparency of nature-based solutions to build trust and accelerate investment, and de-risk forward contract finance.

“Considering an estimated $44 trillion of economic value relies on nature, investing in NatureTech is a sound proposition both financially and for the sake of the planet.” -Nature4Climate

Check out the white paper from Nature4Climate looking at how Nature Tech can help us to solve the climate and nature crises here.

September, 2022

🎤 Polygon: Green Blockchain Summit 2 invites Tom Duncan CEO of Earthbanc

Tom Duncan, Earthbanc CEO speaking alongside Climate Economist Jennifer Helgeson and The Green Techpreneur Marianne Lehnis. Discussing the exciting potential of NFTs and tokenised forward contracts to scale the carbon market.

Watch the full video here: https://youtu.be/VTehJqnSuWw

MAY, 2022

🎤 Earthbanc launches world’s first digital Sustainable Land Bond initiative with United Nations Convention to Combat Desertification (UNCCD) and African Development Bank at UNCCD COP15

Chief Impact Officer, Rishabh Khanna speaking alongside the UNCCD, African Development Bank and CIFOR at UNCCD, COP15. May 2022

Rishabh Khanna, Chief Impact Officer at Earthbanc and a steering committee member of the Initiative of Land, Lives and Peace, presented a new initiative launched together with the UN Convention at the summit — digital sustainable land bonds, which allow carbon buyers to purchase at an earlier stage of development.

“Finance for land and ecosystem restoration makes up less than 1% of all climate finance due to a lack of universal capital market products for these activities. Part of the reason is that monitoring, reporting and verification of sustainable land management has been labor-intensive, sometimes inaccurate and uses fragmented measurement and accounting methodologies.”

Read the full press release from the African Development Bank here.

June, 2022

🎤 Land Restoration and Carbon Removal Partnership

Did you know that Earthbanc is working with the United Nations to finance land restoration and carbon removal at scale?

Together we are developing Sustainable Land Bonds, which offer a cost-effective method for financing ecosystem restoration by pre-purchasing carbon removal.

Earthbanc has already proven this model in India, where finance was used to fund the planting of erosion control trees. The project provided additional income to farmers and enabled the community to increase their resilience to the effects of climate change.

🎤 Earthbanc is proudly backed by the European Space Agency (ESA) Incubator.

Earthbanc offers highly accurate carbon removal and offset projects. Our auditing approach is venture backed by the European Space Agency (ESA) Incubator. We use satellite imagery and AI remote sensing to accurately measure the carbon in trees, vegetation and soil, so you can be confident in your claims.

🎤 Enterprise Services: Earthbanc

IPCC estimates ecosystem protection and restoration could remove 2.9B tonnes of carbon from the atmosphere, every year! This is our largest carbon removal opportunity and fast action is critical to avoid runaway climate change.

Earthbanc is accelerating the flow of global capital to critical land regeneration projects, whilst simultaneously reducing costs and ensuring accuracy.

Visit our website to find out more here.

🎤 Earthbanc is proud to be backed by leading VCs

Earthbanc is proud to be backed by leading VCs including Rampersand, ImpactAssets, CM-Equity AG and the Regen Network Development, Inc.

Together we are accelerating the flow of capital to land regeneration carbon projects to restore ecosystems and remove significant volumes of carbon from the atmosphere.

August, 2022

🎤 The ultimate list of Swedish tech startups & scaleups – 2022 🚀

Earthbanc is proud to be amongst such great companies as we scale up the company and increase our positive climate impact across the world. 🚀

Read More here.

April, 2022

🎤 Forbes: This Climate Fintech Startup Is Paving The Way For Mass Market Adoption Of Land Regeneration 🌱

Avoiding meat, air travel, and the rise of electric vehicles have largely captured the headlines and our imagination, but hope for the future lies in a solution so simple it often falls under the radar: land regeneration.

By transitioning to regenerative agriculture across 2.5 billion hectares, humanity could sequester all of our global emissions every year. Ensuring the survival of our species requires us simply to take care of and respect the earth beneath our feet.

Earthbanc, CEO and Founder Tom Duncan worked in large scale land restoration for 15 years said:

“I worked on some pioneering ecosystem service markets in Australia where farmers would bid to provide ecosystem services to improve water quality, biodiversity values and sequester carbon. That project raised about $300 million and showed me that you could develop and deliver ecosystem services markets, but there just wasn’t enough scale.”

“What makes Earthbanc’s solution so potent in combating the climate crisis is its basis on expert knowledge of land restoration and paying farmers in areas of the world where the impact is the greatest – both for nature and for people,” says Duncan.

Read the full interview and article here: Forbes feature

🎤 Deep dive – Restoring land accelerates carbon drawdown and recovers livelihoods

🌳 Reversing land degradation remains critically important to combating food insecurity, resource conflict and the climate crisis according to Jennifer Helgeson, Ph.D, Earthbanc Strategic Advisor and Climate Economist.

Find out more about how Earthbanc is accelerating the flow of global capital to land regeneration in a way that respects people, planet and profits

September, 2022

🎤 Earthbanc has joined the SmartHead Community 🌱

We are proud to announce our partnership with SmartHead, the carbon accounting and ESG reporting platform. We will work with Smarthead to report Earthbanc’s impact.

We are looking forward to working more closely with SmartHead to support their community to offset their unavoidable emissions and help to meet their ESG commitments.

June, 2022

📢 Big announcement of Earthbanc’s new Advisor Pradeep Monga PhD, former Deputy Executive Secretary, UNCCD

Pradeep is passionate about promoting Nature Based Solutions, Regenerative Agriculture, Clean Energy, Climate Resilience and Sustainable Investments. He has demonstrated inspiring leadership and policy experience of over 35 years at the senior management level with the United Nations, Government, International NGOs, and Resource Institutions, Government (former Deputy Executive Secretary at UNCCD, Bonn; Director of Energy & Climate change at UNIDO, Vienna; Sustainable Development Advisor and Assistant Resident Representative at UNDP; and senior policy maker and management positions in the Government of India),

“I have dedicated my professional journey in shaping and contributing to the nature-based solutions, sustainable energy, eco-restoration, SDGs and climate resilience.” – Pradeep Monga PhD, former Deputy Executive Secretary, UNCCD

Pradeep brings strategic vision, proven leadership, management skills, institutional building, effective communication, funds mobilization and fostering partnerships to Earthbanc as a new Executive Advisory Board Member. His quest for knowledge and passion to make a difference in the lives of people through innovative ideas and solutions in the field of nature based solutions, clean energy, climate change and sustainable investments and translate them into concrete interventions on the ground have defined his academic pursuits and professional life. Pradeep’s passion for nature and environment has powered his journey so far, and with Earthbanc we see the opportunity to regenerate 2.5 billion hectares that the UNCCD has identified through its extensive studies to meet the Land Degradation Neutrality target.

June, 2022

🎤 Impact Hub: Investing in our Future, investing in Peace with Co-Founder, Chief Impact Officer Rishabh Kahnna

Panel: Investing in our Future, investing in Peace

Many conflicts are rooted in land degradation and resultant economic and social impacts. With a focus on the financial sector’s role, this discussion will take a closer look at the underlying causes of modern conflicts, the opportunities in a sustainable economy, and the need to shape resilient landscapes that create the conditions for peace and abundant prosperity through a regenerative economy.

April, 2022

🎤 Stockholm Fintech Week on Impact Stage 💻

Never in history has harnessing the power of finance and technology to deliver sustainable development has been more important than now. Advancing Sustainability through technology track led by Lana Brandorne we had a great lineup of speakers sharing how fintech can support the shift by driving funds, enabling access and facilitating green initiatives.

Driving sustainability from within a large corporation can be an uphill battle, while more nimble and agile companies can provide an innovative technology solution. Pairing innovation with distribution power can provide a real opportunity to tackle some of the world’s biggest challenges.

We live in a culture that glorifies startups as the heroes of innovation—and where most startups claim to be making some sort of positive “impact.” But what are the limits to this naïve techno capitalism? We explored some of the biggest problems facing the world and the actions that venture investors can take against them.

🎤 Mangrove Blue Carbon Project in Sundarbans, India

Our projects are designed for optimum impact for people and the planet, while removing carbon from the atmosphere. Our project in Sundarbans in India is supporting critical ecosystem restoration and soil erosion control. We have planted approximately 40,000 mangroves and helped conserve over 700,000 trees.

Visit our marketplace to support impactful climate action here.

🎤 Pioneering Technology for data-driven carbon removal 🛰️

Earthbanc has developed patent pending satellite imaging, remote sensing AI and blockchain technology to accurately and efficiently monitor, verify and report the carbon removal for each project.

“Venture backed by the European Space Agency Incubator, we are able to provide data-driven carbon removal and offsets that corporates and individuals can trust.”

-Tom Duncan, Earthbanc CEO

June, 2022

🎤 LOGIN Conference Keynote Speech with Earthbanc’s CEO, Tom Duncan

CEO Tom Duncan delivered a Keynote speech on Sustainability and how Earthbanc is making climate action profitable, at Lithuania’s biggest tech festival and conference – LOGIN. Principal Sponsors included SEB and Swedbank, the largest banks in the Nordics and Baltics with strong commitments to sustainable finance.

Earthbanc has signed a partnership with the United Nations Convention to Combat Desertification (UNCCD) to explore options for launching a global fintech and carbon credit platform that finances land restoration and carbon removal.

Read more here.

March, 2022

🎤 Regenerative Finance (ReFi) and Reaching Net Zero

Earthbanc mission is planetary regeneration to stabilise the biosphere and atmosphere, and nothing less. We have built a platform that is financing carbon projects across 100 million hectares by leveraging digital MRV, AI and web3 to scale climate solutions. Carbon offsetting is just one part of a much larger picture when it comes to reaching net zero. Regenerative Finance (ReFi) represents an economic evolution in both mindset and technology that can enable the rapid scaling of climate action required. To achieve our 2030 target of halving current emissions, the State of Climate Action 2021 report calls for a “near doubling of the pace of action”. It states that $5 trillion USD in climate finance is needed annually to reach our 2030 emissions targets.

ReFi is emerging as a key player in innovative climate finance, bridging cryptocurrency and climate action and aligning incentives to enable millions of people to take climate action. With just a few clicks of a mouse they can become a part of meaningful action and be financially rewarded for it.

What is regenerative finance (ReFi)?

ReFi uses money as a tool to solve systemic problems by changing the underlying story that sits beneath our current economic model. It values the accumulation of money and wealth that often comes at the expense of people and planet. ReFi instead uses capital to create healthy and equitable social and environmental systems. To meet our planetary crises of climate change, biodiversity loss and ecosystem collapse, the story underpinning our economic system needs to change.

Enter ReFi. It brings a different story to economics, one where value is considered within the context of the whole and profits are used to regenerate our planet’s ecosystems so they can continue to sustain life, and address our pressing social issues of injustice and inequity. The story of ReFi is circular. It reminds us that money is a human invention — it’s a concept — and it’s not money that is the problem but the current design of money. A central tenet of ReFi is to re-imagine and re-design money and the systems it moves through.

ReFi is grounded in regenerative economics

Regenerative economics is a new philosophical model that advocates for economic-system design to be based on “the universal patterns and principles the cosmos uses to build stable, healthy and sustainable systems”.

In 2017 Tom Duncan, CEO of Earthbanc, developed a simple narrative about how it would function from a first principles basis, meaning the core truths regenerative economics would be built from.

‘Regenerative’ means compensating, and more, for all negative externalities

Being regenerative economically means every activity in the economy that extracts and degrades ecological, human and community health requires a greater regenerative activity that not only compensates for the extraction — but also creates a net improvement in those biophysical indicators.

We can conceive of it in another way using economics vernacular — every negative externality requires a greater positive externality. Generally the source of the negative externality should be the responsible party to fund or carry out the regenerative activity, i.e. the ‘polluter pays’ principle.

Negative externalities have failed to be appropriately accounted for

Traditionally these outcomes would have only been achieved if a government taxed the negative externalities and redistributed the funds to replenish that which was extracted or degraded. Sadly, this principle has only been established in some countries and the overwhelming approach of our economic system is for negative externalities to be absorbed not by the producer, but by the rest of the planet, with negative externalities felt both locally and also globally as diffuse crises — such as climate change.

One of the tragedies of our times is that rates of extraction far outpace regeneration, particularly in regard to the exponentially growing technology commons, and Earth Overshoot Day arrives earlier each year — the annual calendar date each year when humanity’s resource-use has gone beyond what the planet can regenerate in that same year.

Transitioning to a circular economy

Regenerative economics maps a transition pathway to a circular economy that replaces our current linear ‘take-make-waste’ economy.

A circular economy is a systemic approach to economic development designed to benefit businesses, society, and the environment whilst living within planetary boundaries. It is regenerative by design and aims to gradually decouple growth from the consumption of finite resources. In a circular economy, just as in our current economy, shared perceived value drives profit — meaning that regenerative activities can become core business and finance activities.

ReFi is shifting the economy

The ReFi movement is about making positive change possible, with the financial return as a by-product. Money becomes a means and not an end. Incentives in our current economic system are predominantly set to maximise profits whilst socialising negative impacts.

ReFi changes the incentives from to positive externality maximisation for activities that repair, regenerate and heal, while also enabling capital to reach the communities most affected by negative externalities to adapt, mitigate and thrive.

Technology enables ReFi

Web3 is the third evolution of the internet characterised by blockchain technology that enables internet-native money. This form of finance sits outside of the conventional design of money. ReFi uses incentives created through newly designed markets built upon new web3 regenerative finance infrastructure. Programmable blockchain modules combined with AI, satellite and remote sensing data processing with distributed computational power means that today a farmer could deliver regenerative land and water management outcomes to regenerate the damage done by a food manufacturer and their associated negative externalities.

The positive externalities created by the farmer are a regenerative physical asset that can be tokenised in order to track, store and apply their value within the ReFi economy. In this ReFi example, the regenerative land management outcomes are minted by Earthbanc as eco-credits on Regen Network’s ledger and its meta-registry, which can then be sold. Companies such as Microsoft and large investment platforms currently buy carbon credits from Regen Registry, which is produced by a team of regenerative actors, including developers, ecologists and scientists.

New players and accelerated adoption of ReFi economics

Regen Network and their super fast Regen Ledger layer one blockchain enables new eco-credit classes to be created by the open source science community for regenerative activities, and is incentivising the new economics we described above. The key question we now turn to is how do these activities get financed and leverage investment markets to accelerate adoption, beyond the carbon and eco-credits being purchased by companies already committed to net zero and being Earth positive? Massive adoption and scaling is required to realise the exponential decarbonisation roadmap, particularly by 2030.

Enter Earthbanc — the ReFi app that finances carbon credit projects with Sustainable Land Bonds on Regen Ledger, enabling the next one billion unbanked farmers and land stewards to access the world’s first ‘carbon bank’, and connecting investors of all types to regenerative projects. Earthbanc has signed a world-first partnership with the United Nations Convention to Combat Desertification (UNCCD) to finance 100M hectares of land restoration — which we will share the details of in our next blog.

The regenerative finance revolution is just getting started! Stay tuned for more on ReFi and green investing from Earthbanc.

May, 2022

🎤 Carbon and Finance Platform Earthbanc Raises $1.5 Million Pre Seed Round

SAN FRANCISCO, April 05, 2022 (GLOBE NEWSWIRE) — Earthbanc the leading carbon credit and finance platform headquartered in Stockholm with operations across 20 countries, raised a US $1.5M investment in a Pre-Seed Round with participation from Regen Network Development Inc (USA), Rampersand VC (Australia), Visive Capital (EU), Katalista Ventures (Lithuania), Sting Accelerator (Sweden), clients of Jindabyne Capital and Kaai Capital (Australia), European Space Agency Incubator (Sweden) and Regenerative Ventures Holdings (USA). Earthbanc develops carbon projects, sells verified and audited carbon credits, and enables investors to finance carbon removal. The company has audited the carbon stocks of over 13M hectares of forest globally using satellites and proprietary remote sensing technology.

“We welcome the investment from Regen Network Development Inc and Rampersand VC to accelerate the growth of the Earthbanc Protocol platform. We are excited to scale up carbon markets with our technology and onboard millions of farmers around the world to help them monetize their carbon, and give investors access to this fast-growing asset class.” – Earthbanc CEO, Tom Duncan

Regen Network Development Inc CEO, Gregory Landua, said: “Regen Network invests in the best regenerative finance (ReFi) ventures to scale faster. The Earthbanc platform is built for the next 1 billion people coming out of poverty through regenerative agriculture, carbon payments, and regenerative payments – enabling capital to flow where it’s needed to achieve planetary regeneration and stabilize the climate. The Earthbanc app will provide a carbon bank with accessible on and off fiat ramps for users globally, particularly for the unbanked, bringing the next billion users into the regenerative finance revolution.”

“The Earthbanc team has extensive experience in regenerative finance markets, with a demonstrated capability and commitment to the community and environment. Earthbanc’s tier-one relationships with leading NGOs, together with proprietary automation and remote sensing technology, deliver huge value in the fast-growing climate finance and nature-based solution (NbS) carbon markets. Equally important is that Earthbanc provides a win-win outcome to farmers through global carbon market access and meaningful carbon sequestration projects.” -Nicole Small, Investment Director at Rampersand VC

Source: Carbon and Finance Platform Earthbanc Raises $1.5 Million Pre Seed Round

ABOUT EARTHBANC

Earthbanc is pioneering a carbon credit and finance platform that leverages machine learning and MRV technology. On the Earthbanc platform, you can purchase fully audited carbon credits, or choose to invest in carbon removal. The company’s investment thematics include land restoration, regenerative agriculture, agroforestry, blue carbon and large-scale reforestation. Earthbanc’s climate fintech innovation was recognized when it won the Trillion Trees Challenge in 2022, the Mastercard Lighthouse FINITIV program in Spring 2021 and the Rockit Impact Best Product Award for its work with Swedbank. The company is now scaling up it’s nature based carbon removal projects with over 100 million hectares in it’s pipeline.

For additional information, please visit our website.

Do you have any questions or comments? Please add them below, we’d love to hear your thoughts.

Thank you for your support, we really appreciate it.

– Tom & the Earthbanc Team

LinkedIn- Tom Duncan, CEO of Earthbanc